Bayut presents the most sought after areas in the real estate sector

[ad_1]

Bayut, the UAE’s leading real estate portal, has published its Dubai Real Estate Market Report for Q3 2023, revealing the most sought-after areas in the emirate’s real estate sector.

Following the launch of its AI-based property search assistant, the first of its kind BayutGPT, Bayut has once again provided property seekers with a significant repository of data with this new report, designed to facilitate better decision-making and deeper market intelligence.

According to search trends on the platform, property prices in Dubai have continued their upward trend, creating an ideal environment for sellers and owners. The sustained rise in prices is consistent with trends seen over the past 18 months, with increased demand and a greater influx of new residents creating unprecedented booms.

Trends in buying property in Dubai

- Bayut data shows that sales prices for apartments and villas in Dubai’s prime neighborhoods increased by between 2% and 12% in the third quarter of 2023.

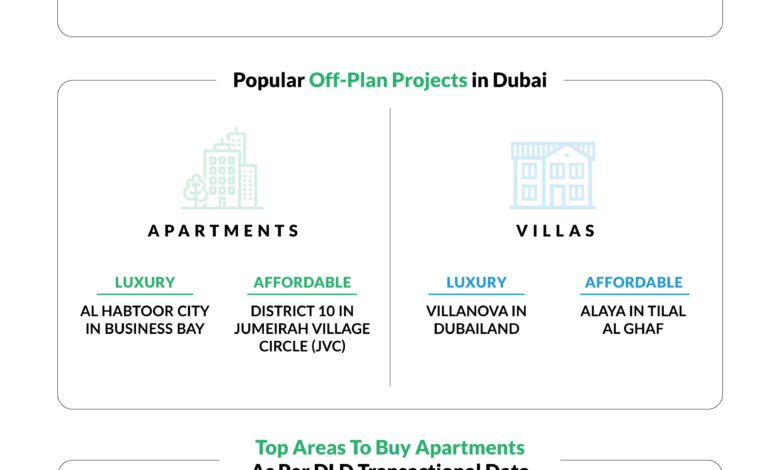

- For affordable apartments and villas, the most sought after areas by home buyers and investors include Jumeirah Village Circle (JVC), Dubai Silicon Oasis, DAMAC Hills 2 and Al Furjan, while luxury property seekers have preferred Dubai Marina, Business Bay , Arabian Ranches and Dubai. Hills Estate in the third quarter of 2023.

- Transactional sales prices in the most popular areas for affordable apartments have seen increases of 9-15%, with the exception of Dubai Silicon Oasis, where average transaction prices fell by around 2%. For affordable villas, the trend is similar: average transaction prices increase by 10-17% in the most popular areas. Notable exceptions have been recorded in The Springs and Dubailand, where transaction prices decreased by 2% and 9% respectively.

- When it comes to luxury areas, most have seen consistent price appreciation of less than 5%, with the exception of Palm Jumeirah, where average transaction prices have continued to rise by 14% to 15%.

- According to data from the Dubai Land Department, there were 30,891 residential property sales transactions (ready-made and off-plan) valued at AED 96.6 billion in the third quarter of 2023.

- When it comes to return on investment based on projected rental yields for apartments, certain areas including DIP, Liwan and Remraam have offered yields of up to 10%, a compelling story for investors. When it comes to luxury apartments, areas such as Al Barari and Jumeirah Golf Estates have offered impressive returns of up to 8%, significantly higher than most global markets.

- Bayut’s trends in return on investment in villa communities also paint a positive picture. Villas and townhouses for rent at JVC offer an average return on investment of over 9%, a very attractive proposition for potential investors. Areas like International City and Town Square also offer ROI percentages above 7%. When it comes to luxury villas, Al Barari is another attractive option for investors with a return on investment of over 8%. The uniqueness of these homes and the limited supply on the market have helped create a niche demand for this area. Similarly, communities like DAMAC Hills and The Sustainable City, which offer a variety of family-friendly facilities, offer a healthy return on investment of over 7%.

Property Rental Trends in Dubai

- As recorded in Bayut, advertised rental prices in popular areas have also increased, with affordable apartment rents in popular areas increasing by up to 11%. The cost of renting luxury apartments has seen an upward trend of up to 13%. Areas with reasonably priced villas have seen price increases of between 3% and 16%, while luxury villa rentals have increased by up to 21%.

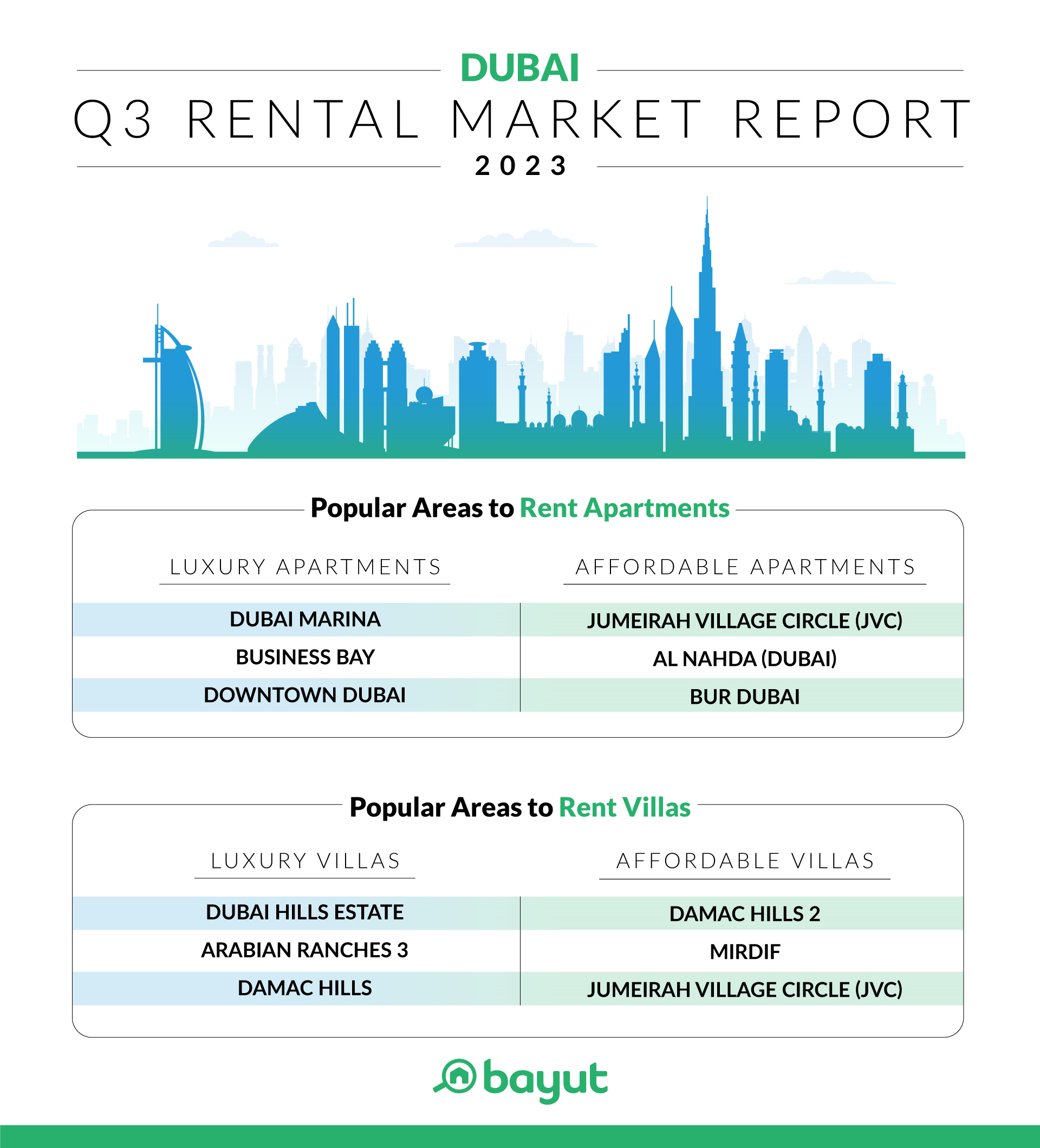

- Affordable accommodation seekers have been focusing on Jumeirah Village Circle (JVC) and Al Nahda in search of apartments. Those looking for villas have mainly considered DAMAC Hills 2 and Mirdif. In the luxury segment, Dubai Marina and Business Bay remain popular options for apartment rentals, while Dubai Hills Estate and Arabian Ranches 3 are sought after for high-end villas.

- When it comes to transactional rental prices, most increases in affordable villa and apartment neighborhoods have been quite modest, staying within 5%, with the exception of villas in JVC, where average transaction prices have increased more than 8%. In the case of luxury apartments, rental transaction prices have remained fairly stable. For luxury villas, rents have increased by 7% to 8% in areas such as Dubai Hills Estate and DAMAC Hills.

While historical trends have generally indicated a cooling period of property market activity during the summer months, with many residents traveling abroad, activity during 2023 remained elevated even during the hottest months of July and August. Transaction volume in the last three months alone approached AED 100 billion, a figure never before seen even in a full year period.

While double-digit growth in rental transactions has become more sporadic, demand for rental units has continued to rise, especially in light of more and more people moving to the UAE in search of better career opportunities and a safer lifestyle.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and Director of Dubizzle Group MENA saying:

It has been a real pleasure to comment on the real estate trends of recent years for the UAE market in general and Dubai in particular. What we are seeing in the third quarter of 2023 reinforces the fact that this market shows no signs of slowing down. While the world’s major economies are still struggling with the post-pandemic economic slowdown, the UAE is on track to break growth records in major sectors, including tourism, real estate and energy. Given the level of interest Dubai is generating these days, it is more important than ever for us to showcase the best of Dubai real estate, highlighting authenticity and availability, which are the cornerstones of how Bayut operates.

We have seen steady growth in platform traffic and inventory throughout this year, a trend that is further validated by DLD’s latest transaction data. Today, our industry is proving resilient in a dynamic and rapidly changing world. At Bayut, we stay alert to changing market conditions and also recommend property seekers use our various tools, including Dubai Transactions, to better understand the market, make smarter decisions and provide transparency to capitalize on some of the amazing things available to them. .”

[ad_2]