Abu Dhabi Realty shows resilience and sustainable growth in the third quarter – News

[ad_1]

In the third quarter of 2023, the Abu Dhabi residential market recorded moderate capital gains. — KT File

Abu Dhabi’s property landscape showed steady improvement in the third quarter, balancing steady growth with prudent market responses, reflecting emerging trends and enduring values within the sector, a report showed on Thursday.

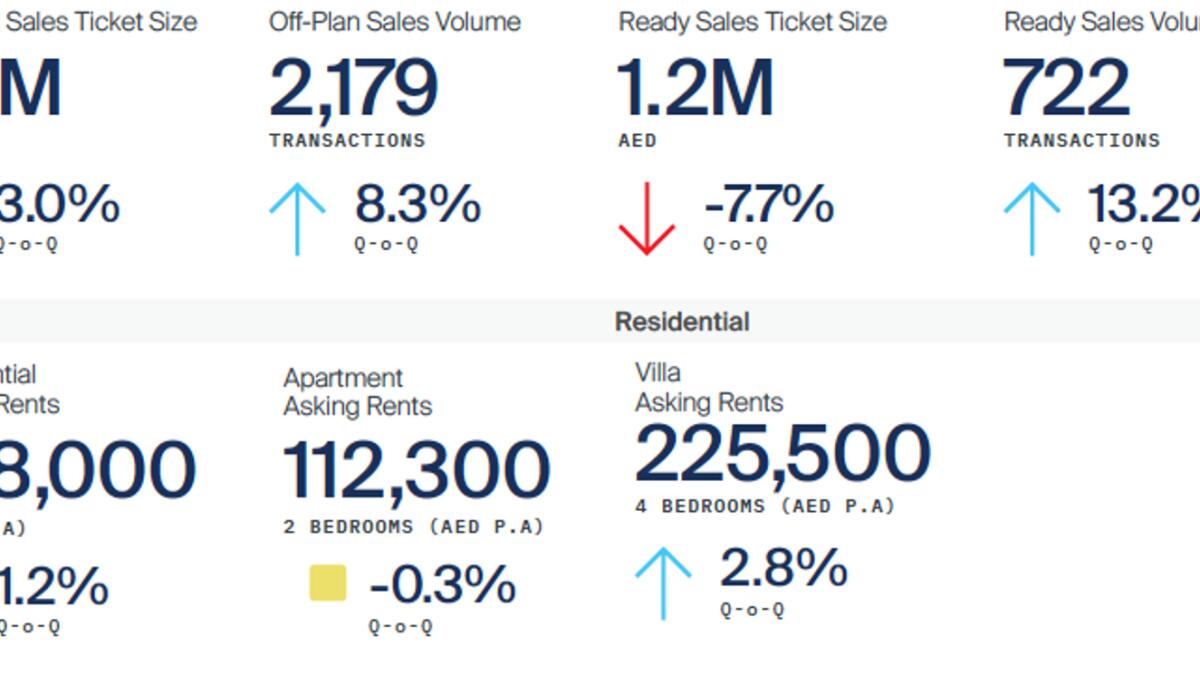

In the third quarter of 2023, the Abu Dhabi residential market exhibited moderate capital gains, with the ValuStrat Price Index (VPI) growing by 4.3 percent annually and 0.8 percent quarterly, reaching 75.5 points. The apartment sector remained stable compared to the previous quarter, recording an annual increase of 3.3 percent to 72 points. Meanwhile, the villa market outperformed with an increase of 1.3 percent quarterly and 5.3 percent annually, reaching 79.2 points.

Declan King MRICS, CEO and Group Head of Real Estate, said: “Abu Dhabi’s real estate sector is undergoing an era of strategic growth and maturity. Given that residential capital gains show a nuanced upward trajectory, it is evident that the market maintains sustainable increases, balancing the balance between supply and demand. “It is great to also see some rallies in commercial asset classes, a reflection of strong economic fundamentals and business activity.”

The VPI of annual rental values in Abu Dhabi expanded by 7 percent annually and 1.2 percent quarterly to reach 80.6 points. Villa rental values stood at 92 points, with a notable annual increase of 9.6 percent and a quarterly increase of 2.8 percent. Apartments experienced an annual increase of 4.7 percent, registering 71.9 points.

The city’s office stock stood at 3.9 million square meters (42 million square feet) of gross leasable area (GLA) in the third quarter, with average office sales prices growing 2 percent quarter-on-quarter up to 9,390 dirhams per m2 (872 dirhams per square foot). . However, office rents in major business districts decreased by 5.1 percent quarterly and 4.2 percent annually.

In the hotel sector, with the current 34,000 hotel keys, the occupancy rate for the period from January to August was 73 percent, 2 percent more than last year, while the Average Room Rate (ARR) and Revenue Per Available Room (RevPAR) increased 22 percent and 24 percent annually, respectively.

The top nationalities of visitors to the emirate during the third quarter were the United Arab Emirates (22 per cent), India (11 per cent), the United Kingdom, Egypt and the Philippines (4 per cent each). Warehouse prices remained stable at the lower end of the price range.

Haider Tuaima, director and head of real estate research, said: “While the secondary market in Abu Dhabi has been growing at sustainable levels, driven mainly by domestic buyers, the off-plan primary market, on the other hand, is likely to attract increasingly more “The attention of international investors, as transaction volumes increased by 99.2 percent compared to last year, not only that, 75.1 percent of all housing sales were derived from off-plan properties “.

[ad_2]