The Treasury Edge: Outperform savings accounts with smarter options – News

[ad_1]

Is it time to ditch your bank for bonds?

The Big Change: Investors Swap Dividend Stocks for Treasuries

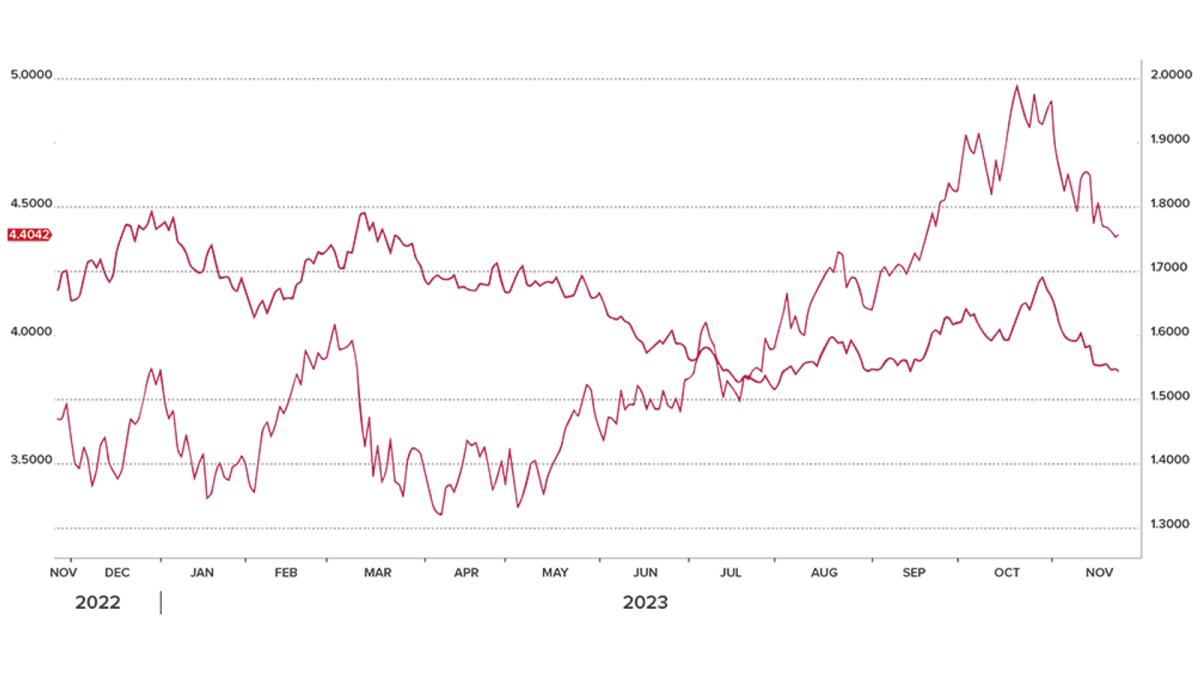

Source: Bloomberg: 10-year Treasury yield and S&P 500 dividend yield comparison chart through 2023.

Actual returns of captivity They are the best they have been in 15 years. This makes them a very attractive part of any investment portfolio. Federal Reserve chief Chairman Powell recently confirmed that interest rates are likely to stay high for a while to help stabilize the economy.

Beyond banks: big players bet on US Treasury bonds

Now, there is a golden opportunity for investors to earn great returns on US Treasury Bills (T-Bills) and Bonds, as compared to traditional Fixed Deposits (FDs). Because? Because FDs depend on the financial health of the bank, and the recent bank failures in March 2023 caused investors to withdraw from bank deposits at a rapid pace and scoop up $48.4 billion in US treasury bills.

Even big players are seeing the benefits. Major US banks are not offering great returns on deposits, while Treasury bonds are doing much better. For example, Berkshire Hathaway increased its investments in T-Bill by 30 percent, recently reaching $126 billion. Likewise, Stanley Druckenmiller has also increased his bullish bets on two-year bonds in recent months.

Weigh the risk and reward

If you’re willing to take a little more risk, you might consider treasury bond futures, such as the US T-Bond Ultra or the Euro Buxl. They differ from Treasury bills because they have a fixed end date, while Treasury bills come in various lengths to fit your investment plan.

With the stock market looking uncertain (only half of S&P 500 companies have met earnings expectations), it’s a good time to think about including safe, high-yield Treasuries in your portfolio. The Bloomberg ECO US Surprise Index has fallen sharply, indicating fewer positive surprises in economic data. Amid such heightened uncertainty, investors would do well to park their funds in a basket of high-yield Treasuries as a safe haven.

Chart Source: Bloomberg – A line chart showing the trend of the Bloomberg ECO US Surprise Index over the past year.

Europe’s economic woes: high yields amid recession risks

The story is similar in Europe, where the economy is slowing and faces risks of recession. The European Central Bank (ECB) has kept interest rates at four percent, the highest since the euro began in 1999. The yield on 30-year Treasury bonds exceeded five percent for the first time since the early days of the global financial crisis in 2007. The yield on 10-year German government bonds rose to a 12-year high of 2.98 percent. Similarly, the yield on 10-year Italian government bonds soared to an 11-year high of 4.956 percent. Although Treasury yields have moderated slightly since then, they remain supported after the ECB paused aggressively. Additionally, ECB President Christine Lagarde said the central bank would not cut rates for at least the next two quarters. This presents a lucrative opportunity for investors to capture the high yields of European Treasuries.

Fixed deposits or Treasury Bills, what awaits investors?

Investors looking for a par investment should choose a U.S. Treasury bill with a duration appropriate to their investment objectives. For example, investors with lower risk tolerance may prefer shorter duration U.S. Treasury bills, which offer greater liquidity and less exposure to interest rate fluctuations. If an investor is willing to lock up his money for a longer period of time, he may be able to earn a higher return by choosing a US Treasury bond with a longer duration.

In terms of yields, the average fixed deposit yield for a one-year period ranges between 3.5 percent and 4.5 percent, while one-year US Treasury bonds offer a more attractive 5 ,25 percent. The superior appeal of US Treasury bills is further accentuated by their high liquidity, fluid tradability in the secondary market, and strong support from the US government. Fixed deposits are currently facing liquidity constraints and premature withdrawal of funds may result in penalties.

In the United States, interest rates reached their highest level in 22 years, fluctuating between 5.25 percent and 5.50 percent. This substantial level is expected to remain stable as the Federal Reserve takes a cautious approach to reducing inflation to its 2 percent target. Projections indicate that US Treasury yields will stabilize at least through the first quarter of 2024. A momentary pause as the labor market shows signs of cooling.

The diversification potential offered by US Treasury bills and bonds is a notable advantage. In a globally unstable economic landscape, the inherent strengths of U.S. Treasuries emerge as a beacon of stability and potential returns.

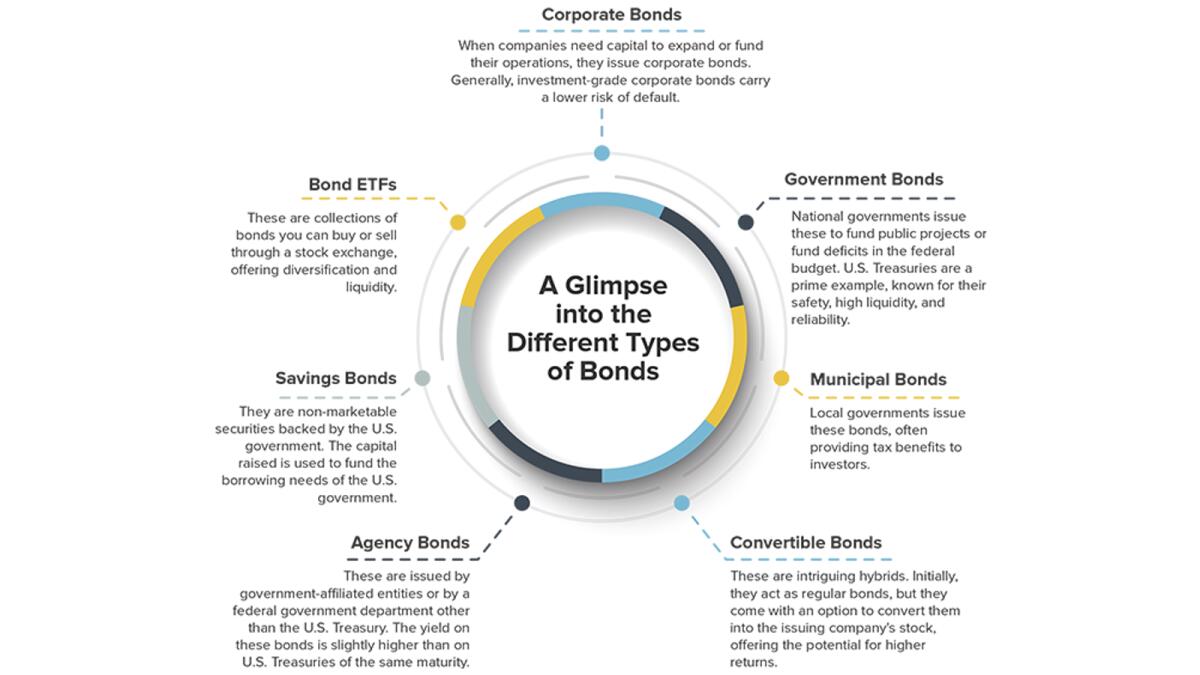

Why invest in bonds?

How do bonuses work?

When you buy a bond, you are lending money to the issuer. They promise to pay you periodic interest payments and return the principal amount to you on the bond’s maturity date. Let’s understand this using an example:

Nominal value:

This is the face value of the bond or the amount you will receive once the bond matures. In our example, it is $1000.

Coupon rate:

This is the interest rate that the issuer agrees to pay the bondholder at a predetermined frequency, say annually or semiannually. With a coupon rate of five percent per year, Company XYZ agrees to pay you five percent of the face value of the bond each year. Therefore, you will receive $50 (five percent of $1,000) annually.

Due date:

This is the date on which the bond will expire and the issuer will return the face value to the bondholder. In our scenario, Company XYZ will return your $1000 after 10 years.

How to invest in bonds in the UAE?

As we navigate a landscape of sky-high interest rates and market volatility, the appeal of U.S. Treasury bills and bonds has never been stronger. With an experienced ally like financial centurywho has been guiding investors through the ebbs and flows of the bond and treasury markets for more than three decades, his experience can help you identify the high-yield potential of treasuries, offering a beacon of stability as you diversify your portfolio away from the market. uncertainties in the banking sector.

Disclaimer: Trading in the financial markets carries a high risk of losses that may exceed deposits and may not be suitable for all investors.

[ad_2]