FTA Corporate Tax Awareness Campaign Witnesses Significant Participation in First Phase

[ad_1]

He Federal Tax Authority (FTA) has confirmed that the first phase of the comprehensive awareness campaign launched this year to introduce the new tax recorded a significant participation of taxpayers subject to Corporate Tax and various agents involved in its application.

The Authority issued a press release explaining that the campaign, which aims to provide ongoing information support to all taxpayers and relevant stakeholders, was part of the TLC’s efforts to ensure the accurate and smooth implementation of Corporate Tax, in collaboration with relevant entities.

The first phase of the campaign included 48 in-person and virtual workshops, welcoming a total of approximately 13,600 participants, including taxpayers from various business sectors and tax sector stakeholders.

He FTA He noted that as part of the campaign, 39 virtual workshops were organized to present Corporate tax and clarify the requirements and procedures for corporate tax registration in both Arabic and English.

The sessions were delivered through the educational platform launched this year on the official FTA website, which offered weekly workshops and which can be accessed by clicking on the following link: Virtual Corporate Tax Workshop Platform.

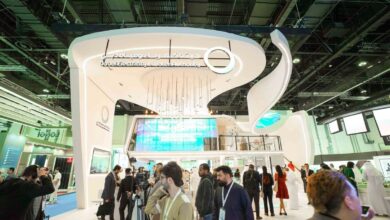

Furthermore, the Authority explained that the first phase of the corporate tax awareness campaign also included nine face-to-face workshops across the seven emirates. The workshops concluded with a session on “General Principles on Taxation of Corporations and Enterprises”, held in Dubai this month (December 2023) and organized by the Federal Tax Authority in collaboration with relevant government and private sector entities.

Director General of the FTA, Khalid Ali Al Bustani He noted that the first phase of the comprehensive Corporate Tax awareness campaign was a great success, generating significant interest and interaction from all stakeholders involved in the implementation of the Corporate Tax.

Al Bustani He asserted that the Authority welcomed a notable number of participants through the in-person and virtual workshops it organized to support and assist taxpayers, facilitating their voluntary compliance with Corporate Tax through simple, transparent and precise procedures.

“The Authority is committed to reaching out to all stakeholders involved in the implementation of the tax system through various channels.”

he added.

“And to that end, we have launched a corporate tax awareness campaign that uses innovative methods to spread tax awareness among all business categories, respond to their queries and support them in overcoming any challenges they face in their efforts to ensure self-compliance. corporate standards. Tax regulations. The campaign aims to provide them with the necessary information, avoid the need to spend time visiting the Authority’s headquarters and ensure constant communication with representatives of the business sectors and other relevant segments of the community.

“Since the introduction of Corporation Tax, the Authority has intensified its activities to raise awareness of the tax and highlight its vital role, objectives and compliance requirements.”

Al Bustani noted.

“The positive results seen during the first phase of the campaign reflect the commitment of business sectors to the implementation of the Corporate Tax Law, which aims to promote the UAE’s position as a leading global business and investment hub.”

He FTA will continue its awareness efforts and organize the second phase of the comprehensive Corporate Tax awareness campaign in 2024. The second phase will focus on various specific topics, raising awareness on the legislation, requirements and procedures for accurate compliance of Corporate Tax obligations. , offering educational programs suitable for all relevant groups and incorporating the latest technologies in this field to ensure easy access to information and prepare the business community to efficiently implement Corporate Tax Law.

The Authority went on to point out that during the workshops, its tax experts review the fundamentals of the Corporate Tax Law, along with its related policies, legislative procedures, schedules and flexible implementation procedures. They highlight the criteria for determining who would be subject to Corporate Tax and who would be exempt, explaining other concepts, such as taxable income, tax rates and tax periods. In addition, FTA experts describe the facilities offered for startups and small businesses, Corporate Tax in free zones, business restructuring relief and tax loss relief, in addition to highlighting rules and transitional provisions for tax groups, among other topics, before to answer questions from Participants.

News source: Emirates News Agency

[ad_2]