Regarding UAE corporate tax, companies believe that there can be no delays in registration

[ad_1]

Dubai: UAE companies cannot afford to delay registering for corporation tax any further, and it is not just about the Dh10,000 fine for any late filing.

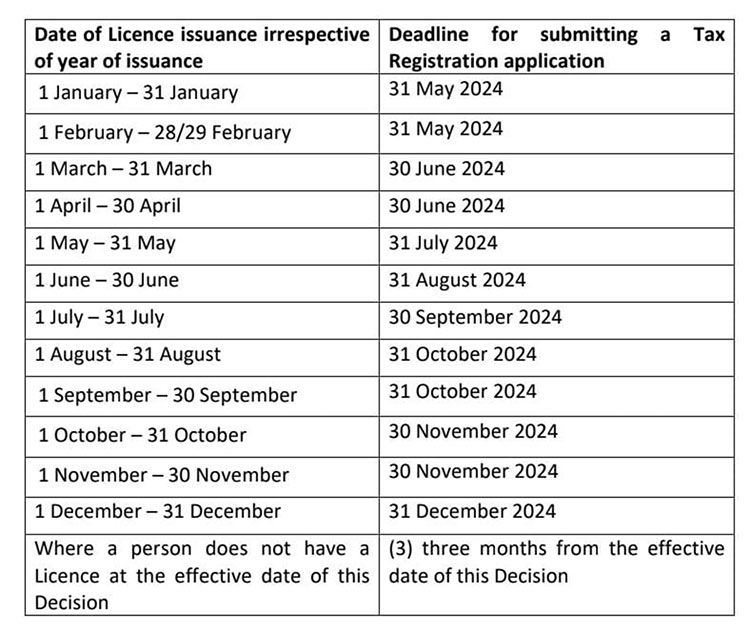

The latest update from the UAE Ministry of Finance provides a clear timeline for companies to make their registration applications. Not only that, companies will have to do it based on the month in which the license was obtained.

Therefore, if the company obtained a license in January, corporate tax registration must be completed before the end of May, according to the Ministry’s latest announcement. The message is clear: all filings and registrations should be expedited by those companies that take a fairly calm approach.

If a business license was issued in June, that entity must register by August 31, 2024. For a December license, the final date will be December 31, 2024.

The last date of registration “now mainly depends on the license issuance date of the existing company,” said Girish Chand, senior partner at MCA Management Consultants.

“The fine for late registration has been specified as Dh10,000, which is similar to the VAT and excise fine for late registration.”

It was on June 1, 2023 that the UAE opened registrations for corporate tax following its announcement that a 9 percent tax would come into effect. In the subsequent period, most larger companies have already sorted out the necessary paperwork. But based on market feedback, some of the medium-sized or smaller companies have yet to pass the first regulatory requirement.

Existing companies must submit their license issuance and ensure that they are registered within the established deadlines. Let’s say an entity that has its license issuance date in January will need to apply no later than May 31, 2024.

– Girish Chand of MCA Management Consultants

This is what the UAE tax authorities are fixing with the latest update.

“The FTA (Federal Tax Authority) highlighted the importance of submitting corporate tax registration applications in accordance with the specified deadlines,” a statement said.

For example, “taxpayers with licenses issued in January and February, regardless of the year in which the license was issued, must submit their corporate tax registration applications no later than May 31, 2024, to avoid violations of the law.” tax”.

If an entity does not have a license by the effective date of March 1, 2024, it must apply for registration within three months, i.e., May 31, 2024.

If the taxable entity is in possession of multiple licenses (for example, a business group with subsidiaries), the deadline for registration is based on the previously issued license to determine the maximum deadline for submitting the application for tax registration corporate’.

According to the latest updates from the UAE authorities, meet these deadlines on corporate tax filings and the company will have done the right thing.

Image credit: supplied

The clock is clearly ticking

“Regardless of the year of incorporation, taxpayers must submit the registration application within 30 to 90 days, depending on the license issued within a month,” said Jitendra Gianchandani, CEO of consultancy firm JCG. “And for new companies, complete the application in 3 months.

“Most companies were lax (in their approach to registration) and did not consider registration as a priority. “Businesses are receiving assessments and general advice prior to registration to avoid penalties for incorrect registrations, such as individuals or tax groups or even a single registration.”

Many taxpayers are evaluating their business modules before registering, either as a single entity or as a tax group, to avoid problems with transfer pricing documentation.

– Jitendra Gianchandani of JCG

Focus your mind on deadlines

Once again, clarity from the latest UAE tax authorities regarding deadlines will focus business owners’ minds on getting all the details right. There can be no laxity. More time.

As long as the details provided are correct, “the entire registration process is done online and there are no difficulties in the process,” said Pankaj S. Jain, CEO of AskPankaj Tax Advisors.

What about individual companies?

A natural person who is a resident of the UAE with business operations and has exceeded the turnover threshold specified in the tax legislation must apply for registration for corporate tax by March 31, 2025. A non-resident person with a turnover exceeding the specified threshold must apply. register within 3 months following the date of compliance with the conditions established to be a Mandatory Subject.

Administrative sanctions will be imposed on those who do not submit their registration applications “within the deadlines specified in the FTA decision” for each category of “taxable persons.”

[ad_2]