New tax in the United Arab Emirates? Here you will find everything you need to know about the global minimum tax

[ad_1]

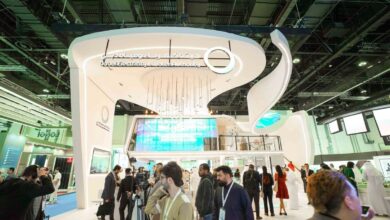

The Ministry of Finance launched a digital public consultation to gather views from relevant stakeholders on the implementation.

The United Arab Emirates Ministry of Finance (MoF) is seeking corporate feedback on the implementation of a global minimum tax in the country. The consultation is open to all interested parties, but the Ministry of Finance is “particularly interested” in hearing from the “global community” of multinational groups operating in the UAE, along with their advisors, service providers and investors.

According to the ministry, the presentations will help inform it on aspects such as national implementation issues, including interactions with the UAE’s Corporate Tax (CT) system; ways to minimize compliance costs, while exploring policy options for the possible implementation of the income inclusion rule (IIR), the undertaxed profits rule (UTPR) and a supplementary domestic minimum tax (DMTT).

Relevant interested parties should submit their responses before April 10th through the ministry’s website.

Here’s everything you need to know:

What is the global minimum tax?

According to the Ministry of Finance’s guidance document, the global minimum tax (GMT) is aimed at multinational companies (MNEs) with consolidated annual revenues equal to or greater than €750 million (almost Dh3 billion).

“Broadly speaking, it ensures that these multinational companies pay a minimum tax of 15 percent in respect of excess profits derived from each jurisdiction in which they operate through two interlocking rules, the IIR and the UTPR, which together are known as as the global base anti-erosion rules. or GloBE Rules”.

Farah Mourad, Senior Market Analyst at Equiti Group, said it serves as a universal reference point agreed upon by countries to establish a basis for corporate taxes. It aims to ensure that multinational companies contribute their fair share and maintain a level playing field.

“Think of it as an international pact between nations to avoid significant disparities within the business landscape. “It is similar to setting a minimum wage for taxes, ensuring that regardless of a company’s location, it plays a role in the societies it benefits from.”

Has the UAE formulated a policy to implement the tax?

As it stands now, the Ministry of Finance has launched a digital public consultation on the implementation of the tax in the UAE. However, the document is solely for the “purpose of obtaining input from relevant stakeholders” and does not reflect the final opinion of the UAE.

“The information contained in this document should not be used or relied upon for making individual or business decisions as it does not represent the final political position of the UAE.”

the document states.

The UAE will announce further details on its implementation of the tax “in due course”.

What does the consultation questionnaire cover?

- Implementation of the GMR in the UAE, design of a possible minimum internal supplement tax in the UAE and administrative issues.

- Substance-based incentives

Is the United Arab Emirates a signatory to the tax agreement?

Farah Mourad: Yes. The UAE signed the GMT agreement in November 2023 and has taken important steps to align with global tax reforms by amending its Corporate Income Tax Law in November 2023. However, the implementation of measures specific standards, such as the OECD Pillar Two standards, has been delayed until 2025.

Which companies in the United Arab Emirates will benefit from the GMT strategy?

George Khoury, global director of education and research at CFI, said the tax is not industry-specific; Therefore, any large multinational company that meets the criteria, regardless of industry, will be subject to the GMT in the UAE.

Has the tax been implemented anywhere else in the world?

Farah Mourad: Yes. The implementation of a minimum corporate tax is already underway in some countries, particularly those that have historically functioned as tax havens. For example, countries such as Ireland, Luxembourg, Switzerland and Barbados are taking steps to comply with minimum tax rates. Switzerland, although known for its leniency towards multinational corporations in the past, is now taking significant steps to address tax evasion. Swiss voters will decide in June whether to adopt a constitutional amendment introducing a minimum corporate tax rate of 15 percent. If approved, this amendment would come into force in 2024, which could significantly alter Switzerland’s tax landscape. Furthermore, on a global scale, more than 40 countries are moving towards the implementation of the minimum tax, marking a significant change in international tax policies.

What do terms like income inclusion rule (IIR), undertaxed profits rule (UTPR), and a supplementary internal minimum tax (DMT) mean?

George Koury: The IIR, UTPR and DMTT are key components of global tax reform under the OECD/G-20 inclusive framework on base erosion and profit shifting (BEPS).

- The IIR is designed to ensure that the profits of multinational companies are subject to at least a minimum tax rate globally. It requires the parent entity of a multinational group to pay a supplementary tax if the profits of its foreign subsidiaries are taxed below a certain minimum rate, which is currently set at 15 percent. This rule is the primary mechanism for enforcing the global minimum tax rate on multinational companies and is similar to the US GILTI (global intangible low taxed income) rules.

- The UTPR acts as a secondary mechanism and support for the IIR. It allows countries to deny tax deductions or require equivalent adjustments for domestic companies that make payments to related entities in low-tax jurisdictions. This rule ensures that if the IIR does not fully address the undertaxation of profits, the UTPR can be applied to “top up” the tax to the agreed upon minimum rate.

- DMTT is a provision that allows a country to implement its own minimum tax rules that align with global minimum tax principles. The DMTT takes precedence over the IIR and UTPR, ensuring that any additional tax revenue generated by the complementary tax is collected domestically rather than flowing abroad. This means that if a multinational’s profits are generated in a country with a DMTT, the supplementary tax will be paid first to the government of that country before considering any IIR or UTPR liabilities.

News Source: Khaleej Times

[ad_2]