GPSSA outlines the calculation of retirement pension and gratuity for UAE employees

[ad_1]

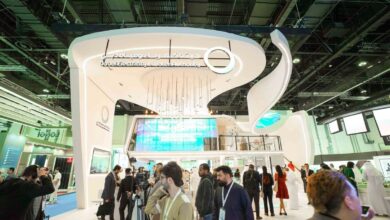

He General Pension and Social Security Authority (GPSSA) explained ways in which policyholders who work in government and private sector entities can calculate their retirement pension and end-of-service bonus according to the UAE Federal Pension and Social Security Law.

As an initial step, registered employees should know how their contribution wages are calculated each month.

For employees in the government sector, the calculation method is based on five elements, namely: basic salary (including the monthly bonus and the allowance specified by the UAE Pension Law), the cost of living allowance, the for children, the insured’s social benefit and a housing benefit with a maximum of AED 300,000.

For the private sector contribution, salaries are calculated based on the details stipulated in the employment contract up to a maximum of AED 50,000.

The second step includes deducting and calculating the average salary from the contribution account for the last three years of employment among government sector employees or for the entire contribution period if the years of service are less.

The starting salary for private sector employees is calculated based on the last five years of work or for the entire contribution period if the years of service are shorter.

The average contribution account salary is calculated for each of the last three or five years of service (depending on the type of sector) multiplied by 12 months. The amount is then collected and divided between 36 months for government sector employees and 60 months for private sector employees.

The last step includes the calculation of the salary from the pension account or end-of-service bonus, whereby the pension is calculated based on the average salary from the contribution account according to the years of service.

A service period of 20 years grants the pension to the insured at a rate of 70% of the average salary in the contribution account, and the insured is granted a 2% increase for each year over 20 years, while there are some cases in which the pension is granted at a rate of 60% for a period of more than 15 years, and at a maximum rate of 100% when the insured completes 35 years of service.

The insured receives a bonus of three salaries from the pension account for any year exceeding 35 years of service.

The calculation of the end-of-service gratuity of a government and private sector employee is based on the average salary to calculate the gratuity, similar to the average salary from the contribution account that was drawn when calculating the pension, which gives as result in the insured receiving a bonus at the rate of 1.5 months’ salary for each year of the first five years of service of the average salary; The bonus is calculated at a rate of two months for each year during the following five years of service, and at a rate of three months for each additional year.

The employee is eligible to receive their bonus from one to 19 years and 11 months of employment. If they work an extra day, they will be entitled to receive the same amount of pension as working less than one month is calculated and considered as working a full month under the UAE pension law.

News source: Emirates News Agency

[ad_2]