UAE debt capital market witnesses 10% rise in last year

[ad_1]

The size of the UAE’s outstanding debt capital market (DCM) increased 10 per cent year-on-year, a new report showed.

According Fitch Ratings UAE Debt Capital Markets Dashboard: 2024the figure increased by the end of 2023 to $270 billion for all currencies, of which 71.4 percent in US dollars (2020: 87.5 percent) and 20.5 percent in dirhams.

(2020: 0.5 percent). Among US dollar DCM issuances, sukuk accounted for a hefty 35 percent, up from 24 percent in 2022.

For DCM issuances in all currencies, the sukuk had a share of 8.7 percent which, while lower than the issuance in US dollars, is increasing due to multiple dirham issuances (2022: 5.2 percent hundred).

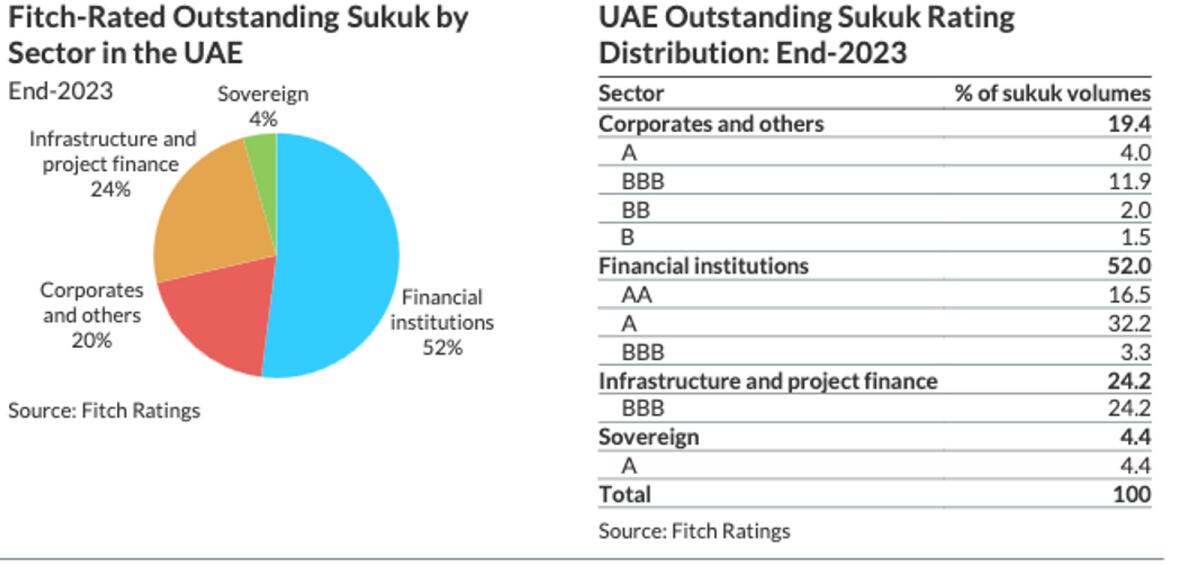

In 2023, sukuk issuance in all currencies rose 115 percent year-on-year ($12.7 billion), while bond issuance was slower, rising 23.6 percent year-on-year ($132.9 billion). The federal government began issuing treasuries in dirhams in 2022 and moved to issuing UAE treasuries after the second quarter of 2023. Fitch rates $22.7 billion of UAE sukuk, 96.5 percent of which is investment grade (2022: 91 percent).

“Approximately 8 percent of sukuk issuers have a positive outlook (2022: 28.7 percent), 92 percent have a stable outlook (2022: 71.2 percent) and no sukuk have defaulted.”

The report, written by Bashar Al Natoor, Global Head of Islamic Finance, and Saif Shawqi, Associate Director – Islamic Financesaying.

The UAE’s debt-to-GDP ratio will remain close to 32 per cent in 2023-2025, below the ‘AA’ category median. This reflects a large surplus in Abu Dhabi, stable debt in Dubai and Ras Al Khaimah, rising debt in Sharjah to finance the budget deficit and continued borrowing by the federal government to build the yield curve and seed the Investment Authority of the Emirates. Fitch expects the central bank to continue moving rates at the same pace as the US Federal Reserve (2024F: 4.75 percent).

“UAE banks are major debt investors, with their investment portfolios increasing 21.7 percent year-on-year in the first nine months of 2023 to $163.6 billion, or 15 percent of total assets. “The banking system’s funding and liquidity profile is strong, supported by deposit growth (11.4 percent year-on-year) outpacing loan growth (5.1 percent).”

the report said.

The UAE had the largest US dollar DCM in the Gulf Cooperation Council (GCC) at the end of 2023, with 37 percent outstanding. Across all currencies, the UAE ranks second only to Saudi Arabia, with a respective share of 30.5 per cent and 16 per cent in the GCC’s total DCM and sukuk markets. UAE entities are key sukuk issuers (22.5 percent of global sukuk in US dollars), investors and arrangers.

The UAE’s outstanding ESG debt increased 165 percent year-on-year ($17.1 billion), with 40.2 percent in Sukuk format. The Higher Sharia Authority ordered Islamic banks and windows to establish independent sustainable businesses and activities within existing business lines, including sustainable sukuk issuance and financing. The Dubai Financial Services Authority waived regulatory fees on ESG listings on Nasdaq Dubai by 2024.

“These initiatives could help drive ESG debt issuance in the near term.”

he Fitch Report saying.

Fitch expects DCM to reach $300 billion in circulation in 2024-2025, and Sukuk to continue to be a growing part of the UAE’s financing mix, thanks to the government’s implementation of the Dirham Monetary Framework, issuers seeking to diversify financing and strong investor demand. Nasdaq Dubai is expected to remain one of the leading US dollar sukuk listing centers globally, giving the UAE a competitive advantage. Risks to DCM’s growth include rising oil rates and prices, as well as issues with sukuk and AAOIFI-Sharia adoption.

News Source: Khaleej Times

[ad_2]