Expected increases in office rents and occupancy rates in the near future

[ad_1]

Increased demand following the pandemic has resulted in the absorption of over 11.5 million sq ft in the last 3 years, with over 9 million sq ft absorbed in the last 18 months.

Are office rents expected to continue rising? This is a question we are often asked, and the short answer when looking at current supply and demand is that the only way for office rents and occupancy levels to increase in the short term is to increase.

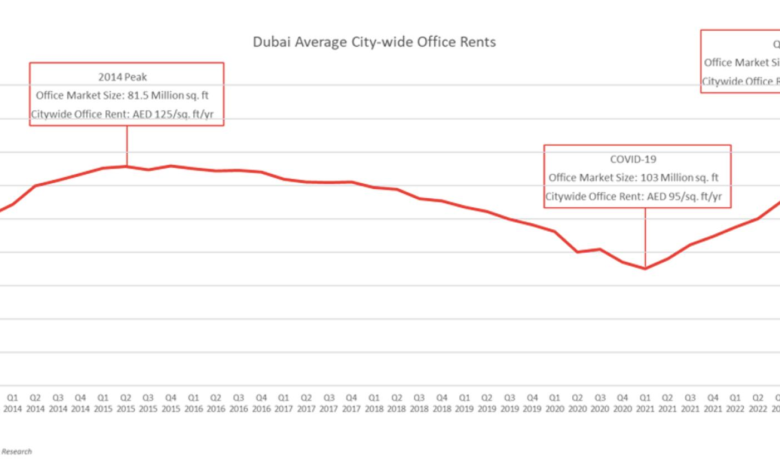

Following the fall of the pandemic, Dubai’s office market continues its upward trend with rents and occupancy levels across the city at record levels driven by positive economic sentiment, ease of doing business and a number of economic factors that result in job creation and the influx of occupants. This is evidenced by the greater number of new license registrations throughout the Department of Economic Development (DED) and free zones. We have already surpassed the 2014 office rental peak and Dubai’s office market has seen a more than 45 per cent increase in office rents across the city since the pandemic, with a year-on-year increase of 24 per cent.

During the peak of 2014, the total size of the office market was just over 81.5 million sq ft, and office rents across the city were Dh125 per sq ft per year, while today the size The market’s size has grown more than 32 percent and is 107.6 million square feet with offices throughout the city. rents exceeding Dh138 sq ft/year.

Shortage of office stock in the near future

Demand is outstripping supply at an unprecedented rate and office occupancy levels are at an all-time high. Prime/Grade A office occupancy levels are around 92 per cent, while city-wide office occupancy levels are at 87 per cent. To give perspective, only 75 percent of the office market was occupied before the pandemic.

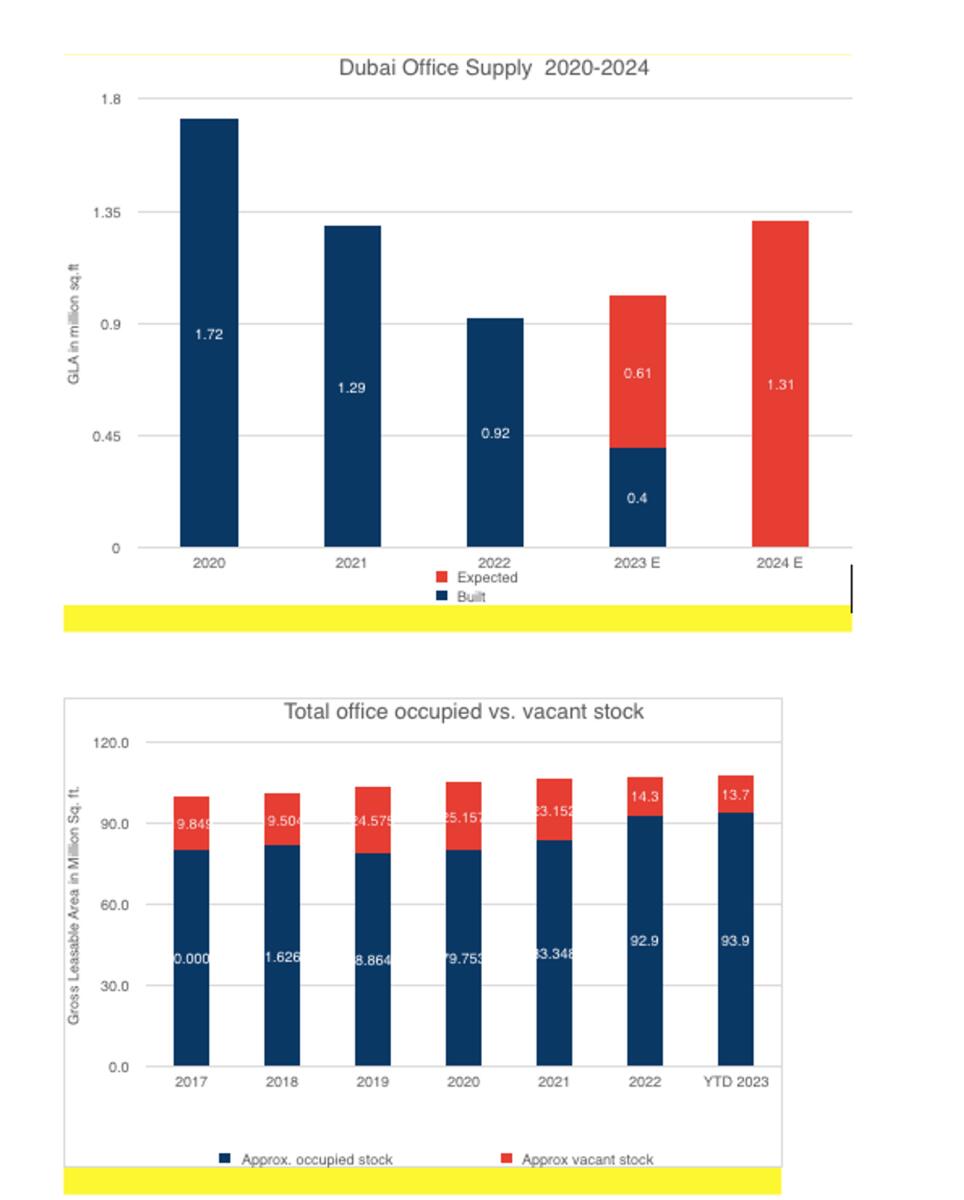

This post-pandemic surge in demand has resulted in the absorption of over 11.5 million square feet of office space over the past three years, with over 9 million square feet absorbed in the past 18 months alone. By contrast, only 2 million square feet of stock is expected to be delivered over the next two years, and most of the stock will be pre-leased, so the supply shortage will not be addressed.

Uptown Tower by DMCC was recently delivered (fully pre-leased), adding over 495,000 sq ft of office space and bringing Dubai’s office stock to 107.6 million sq ft. Previously, the major office transfers in 2022 were made in the Expo District, Deira Enrichment Project, Dubai CommerCity and Dubai Hills Business Park. Other projects expected this year are the office component of One Zabeel, Innovation Hub One at DIFC and the next phases of Dubai CommerCity.

6 Falak at Dubai Internet City and Tecom’s Innovation Hub Phase 2 are seeing strong pre-leasing activity and are expected to deliver in 2024.

Most of the office supply portfolio is already pre-leased, offering very limited availability upon delivery.

While free zones such as Dubai South, Expo District and Tecom’s outer clusters have some office inventory, DED-licensed core locations are severely short on supply. With very limited new land office stock currently under construction, we are witnessing many individual owners (with a portfolio of land) and free zones looking to activate new office projects or upgrade/repurpose existing office stock. However, as it would be a construction cycle of at least two to three years, we expect to have a shortage of office supply in the short term, thus creating further upward pressure on rents and occupancy levels.

The challenge

With the pace at which we are seeing absorption and with the lack of supply of new and secondary offices, we anticipate a serious lack of supply of Grade A office stock over the next 18 to 24 months. That said, with many developers activating office projects, we expect the supply-demand imbalance to be resolved by 2026, when the majority of ongoing projects are delivered. Additionally, major global occupiers with large office needs can find purpose-built options within free zones.

Rising rents and occupancy levels

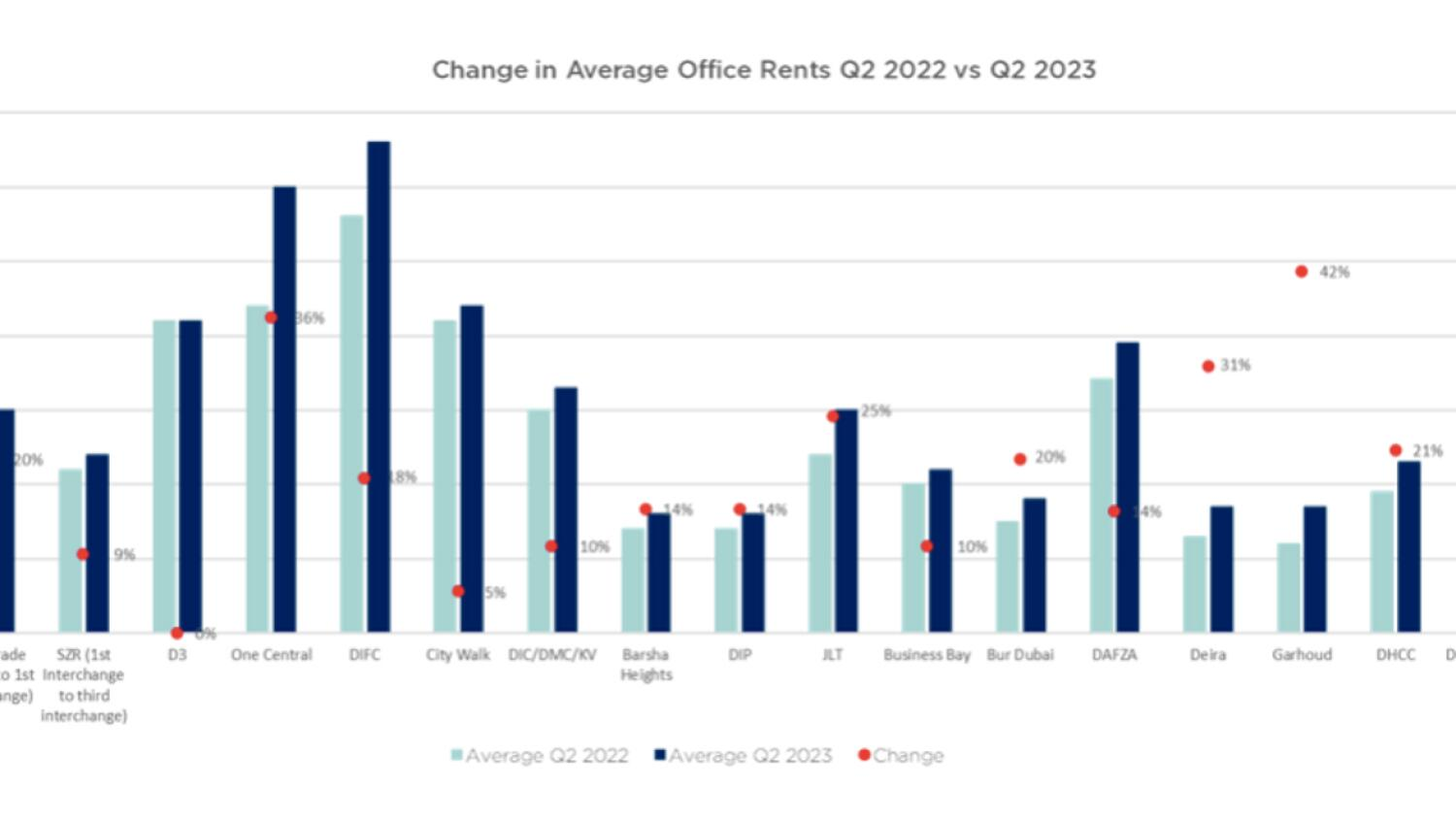

As office demand intensifies across the city, office districts have witnessed year-on-year increases in the range of 5 to 50 percent.

This demand is mainly focused on Grade A projects both in free zones and on land. Driven by their sustainability mandates, occupiers continue to gravitate towards new Grade A developments with regional and international tenants actively seeking single-owned and efficiently managed green buildings. Although older stocks are seeing indirect demand, they are expected to face medium to long-term challenges as they continue to age and would require significant investments to upgrade them.

We have observed that rent increases are greatest in districts where most of the office stock is strata (an office building owned by multiple owners), as they were increasing from a significantly low base compared to the strata property stock. Freezone and single owner.

Aware of favorable market conditions, many landlords (especially those with furnished units) are now achieving asking prices or, in some cases, premiums over asking prices, in addition to receiving fewer rent checks.

As the need for near-term plug-and-play offices continues to increase, particularly from new market entrants looking to set up operations and expand, we are witnessing an increase in inquiries from office space operators with services. Most global serviced office occupiers, such as WeWork, ServCorp and Regus, are operating at maximum capacity and many more local operators are also at high occupancy levels.

Where does the demand come from?

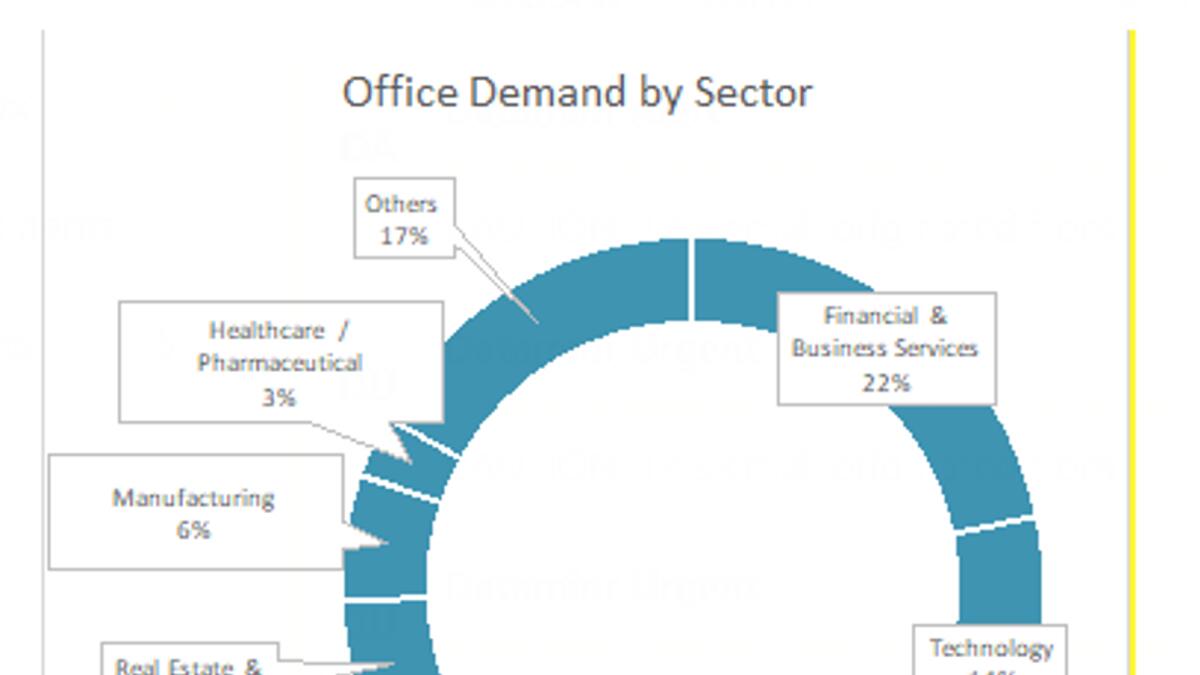

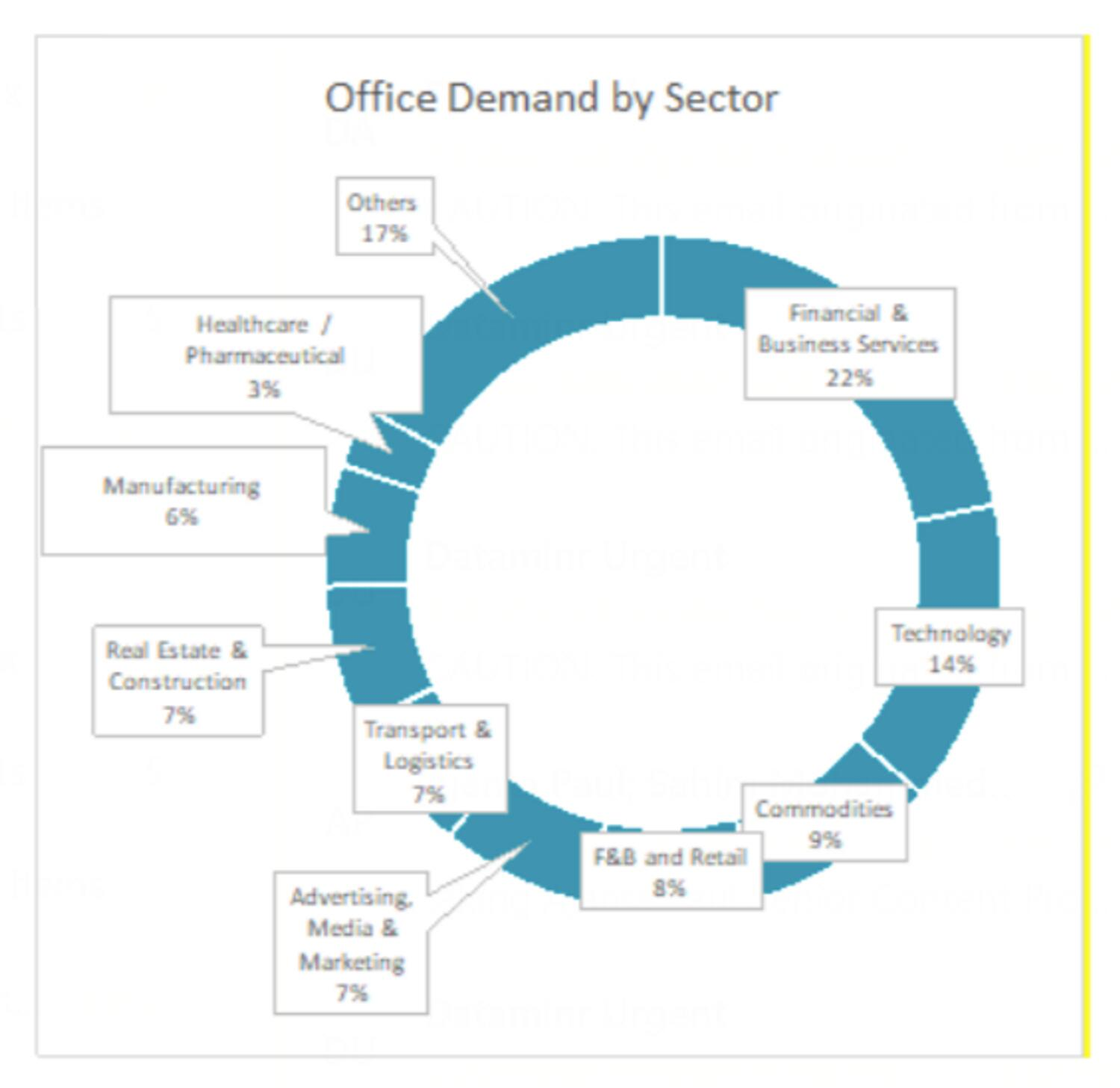

We have seen demand split almost equally between new market entrants and existing occupiers looking to expand. Demand comes largely from the banking, financial and business services sectors, followed by the technology sector. The strong economic backdrop, ease of doing business and competitively priced office rentals compared to other gateway cities, coupled with Dubai’s central location and overlap with multiple time zones. in the western and eastern markets make it ideal for companies to locate their offices here.

Market outlook

Tenants are increasingly aware of changing market conditions and, where possible, are managing within existing premises through workspace strategies and opting for hybrid working as spatial expansion options are increasingly more limited.

On the other hand, sole proprietorship Grade A assets are well positioned, both in terms of overall rentals and occupancy levels, and due to strong pre-leasing interest, free zones and prominent individual landlords are looking to activate the following phases of your office. Projects. However, aging office stock is likely to face challenges in tenant retention and satisfaction. Owners of older buildings will be forced to consider renovating their underperforming assets to improve rental profitability and align with the market.

With sustained demand from new market entrants, expansion of existing operators across all sectors and very limited available office stock, we expect office rents in Dubai to continue to rise, with another expected increase of 10 to 20 percent. percent in prime areas along with occupancy levels facing upward pressure over the next 18 to 24 months.

News Source: Khaleej Times

[ad_2]